Table of Contents

What is a 941 Form?

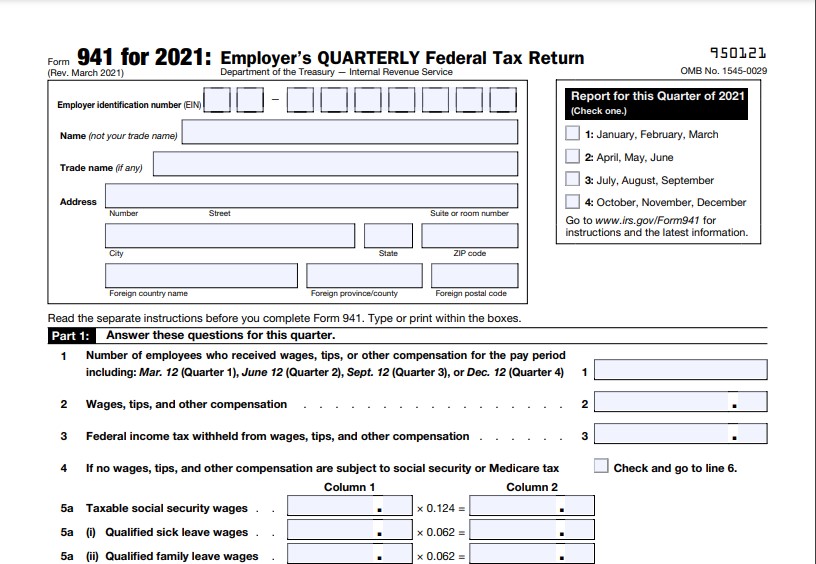

IRS Form 941 is made use of to report quarterly Federal taxes. Example usage: Companies use this form to report wages, tax obligations, and also pointers.

Form 941 is a pay-roll form reporting the overall government tax obligations that companies have held back from employee payment during the quarter.

When Would Certainly You Require To File A 941?

If you paid earnings, if your employees reported ideas to you, or if you held back Government revenue tax obligation, social security tax obligation, and Medicare tax obligations, you should submit this form.

If you submitted a Form 941 last quarter, you must submit a return for this quarter, even if you have no tax obligations to report. There are many exceptions to this.

What is Form-941 Made Use of For?

Due to the fact that it details each worker along with his or her social security number and complete yearly wages for the period, form 941 can be made use of as a quarterly payroll recap.

FICA taxes include social security and medicare tax obligations. These taxes are split 50/50 in between the worker as well as the company. Both have to pay around 6.2 percent of incomes for the social security part as well as 1.45 percent for the Medicare section. These tax obligations total to approximately a 15.3 percent take on quarterly salaries. FICA tax legislations are always altering, therefore, are the rates, however, these are the fundamentals of how it functions.

Can Form 941 Be E-Filed?

You can send Form 941 digitally using Federal E-file, as well as you can pay any type of tax obligation debt digitally by using a tax preparation software program or via your tax obligation expert.

Where to Get Form 941

Form 941 is readily available online at the IRS internet site. You can download and install a blank duplicate, or you can complete it online then wait to your disk drive and also print out the finished duplicate. You can access the form below.

941 Form 2021 Printable

[embeddoc url=”https://www.irs.gov/pub/irs-pdf/f941.pdf” download=”all” viewer=”browser” text=”941 Form 2021 Printable”]941 Form 2021 Instructions

[embeddoc url=”https://www.irs.gov/pub/irs-pdf/i941.pdf” download=”all” viewer=”browser” text=”941 Form 2021 Instructions”]Schedule B 941 Form 2021 Printable

[embeddoc url=”https://www.irs.gov/pub/irs-pdf/f941sb.pdf” download=”all” viewer=”browser” text=”Schedule B 941 Form 2021 Printable”]Schedule B 941 Form 2021 Instructions

[embeddoc url=”https://www.irs.gov/pub/irs-dft/i941sb–dft.pdf” download=”all” viewer=”browser” text=”Schedule B 941 Form 2021 Instructions”]Who Utilizes Form 941?

Employers use this form to report their withholding info to the IRS. Workers don’t get a copy. Form 941 is furthermore utilized to Adjust amounts due; Compute a complete pay-roll tax responsibility: and also Subtract quantities currently paid to get a final amount of overpayment or underpayment.